Here Are Seven Ways your Small Business Can Use a Merchant Cash Advance

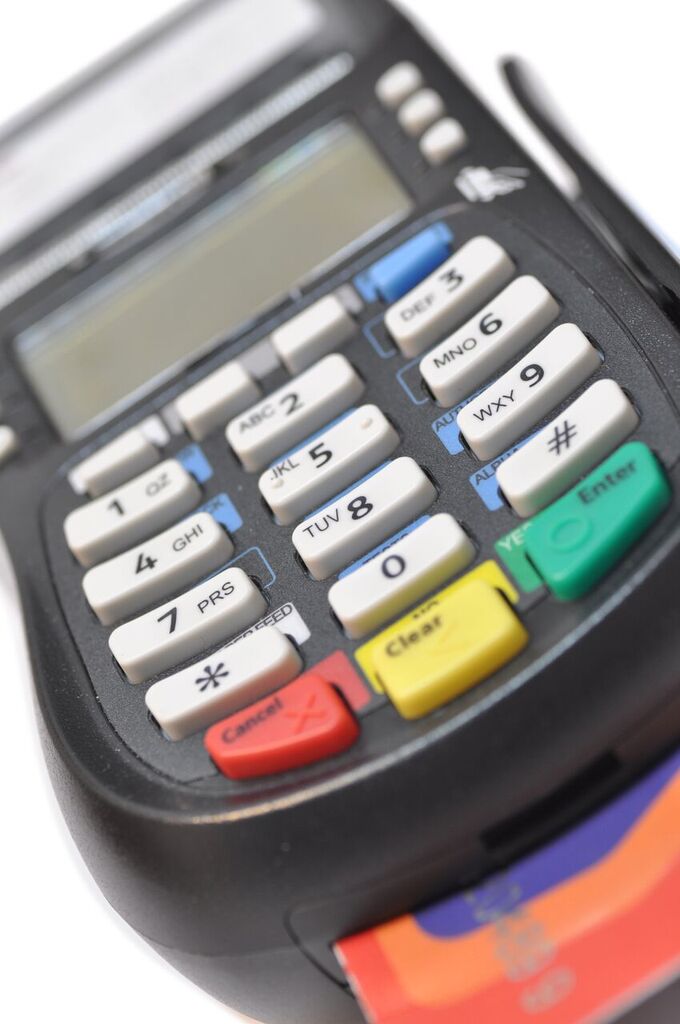

Unlike traditional loans, a merchant cash advance can be used any way your small business chooses. This type of funding is based on your future credit card sales. It works much different than a traditional loan. The approval process is much less stringent and much quicker. Even businesses with less-than-perfect credit can qualify. Repayment is taken as a portion of your daily sales. You can get money when you need it. Here are seven ideas on how you can use your merchant cash advance to benefit your business.

Unexpected expenses

You may have a piece of equipment that breaks down and can’t wait for a bank loan to get approved. Quick funding lets you take care of business without depending on family, friends or the bank.

Staffing needs

The cost of hiring new staff can be expensive. You need more staff to meet demand, but you need more business to pay for more staff. Use your merchant cash advance to cover expenses.

Increase cash flow

Having money on hand without taking out a loan can help you maintain and build your empire.

Equipment upgrades

When equipment becomes obsolete, use your merchant cash advance to purchase new. Keep your business fully operational without taking on more debt.

Pay bills

If your business is having a down month, pay for expenses with a merchant cash advance. Don’t stress over missing payments and possibly damaging your business credit.

Marketing and advertising

Sometimes, you need a boost of working capital to expand your customer base. Marketing agencies can really give your business the chance to grow, but they aren’t inexpensive.

Renovations and improvements

If you need money to remodel, add a second location or make repairs, a merchant cash advance can be just the ticket to have extra cash on hand to make improvements without breaking the bank.

For more information about funding opportunities, contact Muth Capital at 914-999-2855.